Tariffs set to hit Ireland, where US drugmakers play tax games

- The San Juan Daily Star

- Aug 19, 2025

- 5 min read

By Rebecca Robbins

President Donald Trump’s planned 15% tariff on medicines from Europe has shined a spotlight on Ireland, which sends the United States tens of billions of dollars’ worth of cancer medications, weight-loss drug ingredients and other pharmaceutical products each year. No other country sends more.

Manufacturing blockbuster medications there offers tax benefits for American drug companies. But the appeal of Ireland for the industry goes deeper: Drugmakers have long shifted their patents and profits there, as well, to avoid billions of dollars in taxes. Such strategies can be legal but have been repeatedly challenged by tax authorities.

For decades, the free flow of medicines across borders “had the side effect of more or less providing manufacturers free rein to play tax games,” said Brad Setser, an economist at the Council on Foreign Relations.

The tariffs on medicines from Europe, which could go into effect within weeks, create a new calculus for drugmakers. If they keep production in Ireland, they face billions of dollars in levies. If they move manufacturing to the United States, they will most likely face a range of increased costs.

Drug companies could devise creative ways to limit the damage. They will be better positioned to weather the tariffs if they have “sophisticated tax skills,” Wall Street analysts at the investment bank Leerink wrote to investors in July.

Most executives and other employees of multinational drug companies are in the United States. So are a majority of their laboratories, clinical trial sites and, crucially, sales. But many of these companies register only a tiny share of the profits in the United States, helping them lower their overall tax bill.

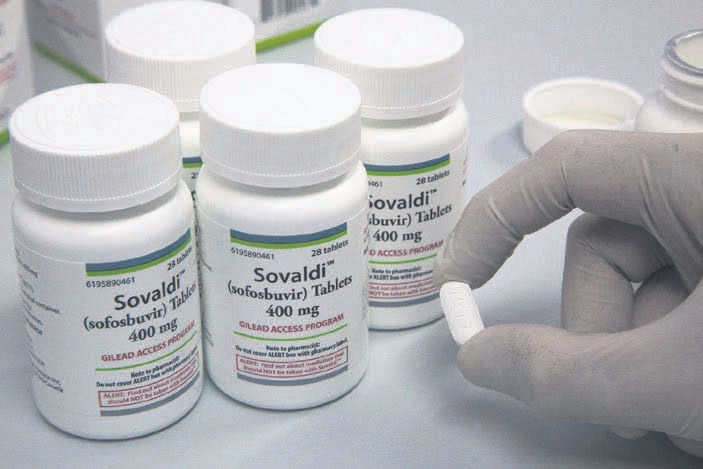

Forest Laboratories, now owned by AbbVie, shifted profits to Ireland for the antidepressant Lexapro, Gilead Sciences with its hepatitis C treatment Sovaldi and Regeneron with the eye drug Eylea.

In the past three years, some of the largest drugmakers booked 91% of their profits overseas, on average, up from 76% in the mid-2010s, according to an analysis by Martin Sullivan, a tax economist who writes for the trade publication Tax Notes.

Technically, drugmakers don’t have to put their manufacturing in Ireland in order to shift profits out of the United States. Still, the strategy often involves putting it there.

In recent months, as Trump threatened to impose punishing tariffs on medicines, most of the largest drugmakers announced plans to spend billions of dollars building or expanding U.S. factories.

This spring, while under the threat of tariffs, American drugmaker Merck announced a change for its cancer medication Keytruda — the bestselling drug on the planet — which it produces mainly in Ireland. Next year, the company plans to begin shifting Keytruda production for American patients to the United States.

In the meantime, Merck and others have scrambled to transport medicines while they could still flow freely. In the first five months of this year, shipments of pharma products from Ireland to the United States were up nearly fourfold compared with the same period in 2024. Merck said it had shuttled enough Keytruda to the United States to supply American patients for the rest of the year.

Irish trade data shows that about $35 billion worth of ingredients used in weight-loss drugs were exported out of Ireland in the first three months of this year. The bulk of those shipments were from Eli Lilly, which manufactures active ingredients for its popular obesity drug Zepbound in Ireland.

Unlike India and China, where local companies manufacture low-cost generics, Ireland is where the world’s biggest drugmakers produce expensive brand-name medicines.

Tax experts and pharmaceutical executives have said that tariffs would be at best a blunt instrument for discouraging corporate activity in Ireland. Changing U.S. tax rules could more directly address the incentives that are motivating drugmakers, they said.

Lower tax rates overseas “drove a lot of the innovative companies to make drugs in low-tax islands like Ireland and Singapore and Switzerland,” said David Ricks, CEO of Eli Lilly. He called for lower tax rates for companies making products in the United States.

It remains to be seen whether tariffs and new U.S. factories will spur drugmakers to book more profits — and pay more taxes — in the United States. Where a company holds its intellectual property is more important for its tax bill than the location of its manufacturing, tax experts said.

Nearly all of the largest pharma companies have a manufacturing presence in Ireland, in some cases dating back decades.

Today, a vast majority of Ireland’s corporate tax revenue comes from multinational drug companies and tech giants, which have also used Ireland to shift profits.

Many large American drugmakers have complex webs of subsidiaries around the world, including in Ireland. In a typical arrangement, the Irish subsidiary and its parent company enter into a licensing deal: The subsidiary gets to exploit a drug’s intellectual property, for instance by funding research. The subsidiary pays the parent company royalties but keeps most of the profits — often billions of dollars a year.

This arrangement has allowed pharmaceutical companies to move profits out of Ireland and book them in tax havens like Bermuda or the Cayman Islands, which impose no income taxes at all, and where companies have no actual business activity.

Over the past decade, global tax authorities have increasingly cracked down on such tactics. It is not clear how much the practices have abated.

Irish officials said their country should not be dismissed as a tax shelter, pointing to the tens of thousands of Irish workers employed by multinational pharma companies. “If it was a tax scam, then those people wouldn’t be working,” said Daniel Mulhall, a former Irish ambassador to the United States.

There was some sense of relief in Ireland that the 15% tariff was not higher, said Neil McGowan, an organizer for an Irish union that represents thousands of pharmaceutical workers.

“It’s not a good situation to be in,” he said. “But it could have been a lot worse.” In the longer term, he said, “there are still concerns about what it’s going to mean for people working in the industry here.”

Drugmakers are expected to keep at least some of their manufacturing in Ireland regardless of the tariffs. But European Union officials, worried about the bloc’s No. 1 export to the United States, fear that drugmakers will cut jobs or cancel or scale back planned expansions.

Johanna Herrmann, a spokesperson for Merck, said no job cuts were being planned at the company’s Irish plants, which will continue to make Keytruda for countries other than the United States, along with other drugs.

Merck recently broke ground on a factory in Delaware that is expected to begin making Keytruda in 2030. Until then, the company says, U.S. contract manufacturers will handle production for American patients. Plans to shift more of Merck’s production to the United States were underway long before talk of tariffs, Herrmann said.

Comments